My PhD at AIFMRM allows me to develop skills that are attractive for the job market and sends me travelling around the world. My supervisor Dr Co-Pierre Georg has been extremely supportive and with his help, I successfully applied for a 3-months internship at the Bank of England (BOE) in summer 2017. I was about one year into my PhD and had worked with a contagion algorithm for asset fire-sales. Something the Bank of England was also interested in…

So, off to London

| In a | Nutshell |

|---|---|

| What | Financial Stability Research Internship |

| When | July to September 2017 |

| Where | Bank of England, UK |

| Perks | Paid internship |

| Networking and heavy exposure to contagion literature | |

| Improving modelling and programming skills | |

| Escaping South African winter for London summer |

|

What does the Bank of England do?

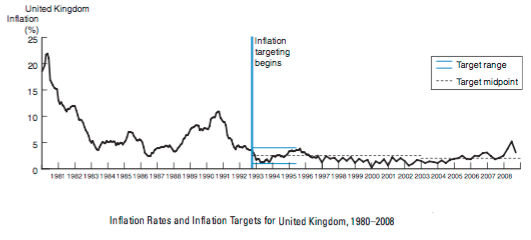

The BOE is the “guardian” of the UK’s financial system and implements its monetary policy. For the last thirty years, its main mandate has been to monitor and ensure price stability to facilitate investment spending and economic growth. Inflation targeting is used as a tool to achieve price stability and so far it has done a pretty good job as can be seen in the chart below.

|

However, during the financial crisis that erupted 10 years ago, we discovered a disconcerting, seemingly worsening, fragility within the financial system. It seemed central banks ought to do more than just keeping inflation in check, which is why countries around the world gave them an explicit mandate for keeping sound financial system stability. The BOE too has a large research department with Economists, Mathematicians, Physicists and other scientists studying the ins and outs of systemic risk.

|

|

However, compared to the singular focus on inflation as a monetary policy objective, financial stability is a vague and messy topic. It involves complex interdependencies and a myriad of factors. How do we define fragility? Which indicator is the most important and how do we detect imbalances and vulnerabilities building up?1

At the heart of the financial system are commercial and investment banks; so the assessment of financial stability often starts there. Indeed, bank stress-testing is one of the main priorities of the financial stability department of the BOE. The objective is to evaluate the soundness of banks’ capital, liquidity and debt position in accordance with the Basel 3 regulations. However, focusing on the health of individual institutions (via micro-prudential regulation) is not enough as the crisis has shown. Financial stability entails a systemic dimension, hence, policy makers are now talking about implementing a macro-prudential (i.e. system-wide) policy framework.

In line with this, there is great interest in research that contributes towards understanding so-called amplification mechanisms. Those are mechanisms that describe how losses spread across various asset classes and financial institutions. For example, the crisis started with distress in the subprime housing market, which caused severe write-downs in the asset-backed securities segment, which in turn bankrupted hedge funds and investment banks and eventually brought the global financial system to the brink of collapse. The mechanisms behind these contagion processes are not well understood and spurred research in the field of amplification modelling.

|

Channels of contagion

In the literature that deals with those amplification processes, researchers have identified vulnerabilities in terms of funding contagion, liquidity contagion and “fire-sale” contagion. Funding and liquidity contagion usually occur in bilateral contract relationships, e.g. when one bank borrows from another and defaults, this may cause a cascade in the financial network, affecting all banks connected via a direct link. A nice review on the mechanics of funding contagion was done by Upper, Christian (2011): Simulation Methods to Assess the Danger of Contagion in Interbank Markets, Journal of Financial Stability 7(3):111-125.

Another very nice read in this respect is: Summer, Martin (2013): Financial Contagion and Network Analysis, Annual Reviews of Financial Economics, 5, 1–38.

In contrast to this, indirect contagion effects can arise from common asset holdings of financial institutions. If a bank faces a large shock to one of its assets that puts its solvency at risk, it may be forced to sell part of its portfolio at a discount ‘fire-sale’ price. Because of mark-to-market accounting, this lower price affects all banks holding this asset and triggers feedback effects, for example, banks could reduce the amount of debt they are holding. A more fancy way to say this is that indirect contagion can involve negative fire-sale externatilities accompanied by debt deleveraging. Shleifer and Vishny (2011) gave a theoretical foundation for fire-sales in their paper “Fire Sales in Finance and Macroeconomics”. The paper inspired many other work, see for example Greenwood et al. (2015), Eisenbach & Duarte (2014) and Conte & Schaaning (2017).

A big issue in the fire-sale literature is the lack of an empirical foundation of the asset-specific price-effect which depends on the asset’s liquidity and drives all fire-sale contagion models. How much does the price drop given the trading volume and stress scenario? We really don’t know how to treat the liquiidty in different asset classes under varying market conditions, so we need a lot more research to shed light on this.

|

Now, why am I telling you all of this contagion stuff? Because my main task during my internship was to create a model that includes fire-sale and funding contagion channels and tracks how losses spread from banks to other financial insitutions, such as money market funds, dealer banks, insurers etc. This also involved a “deep dive” into the financial system architecture to better understand interconnectedness between different types of institutions. One of my contributions was a map of asset, funding and collateral flows for bank finance operations and market based finance operations. I also coded a first iteration of the resulting contagion model using python and object-oriented programming.

If you asked me for one thing that characterises working at the BOE I would say the affability of its staff. It might have been the stereotype british politeness, but compared to my previous working experience my colleagues were truly friendly and supportive. I am very grateful for the insights they provided me during my internship.

Living in London

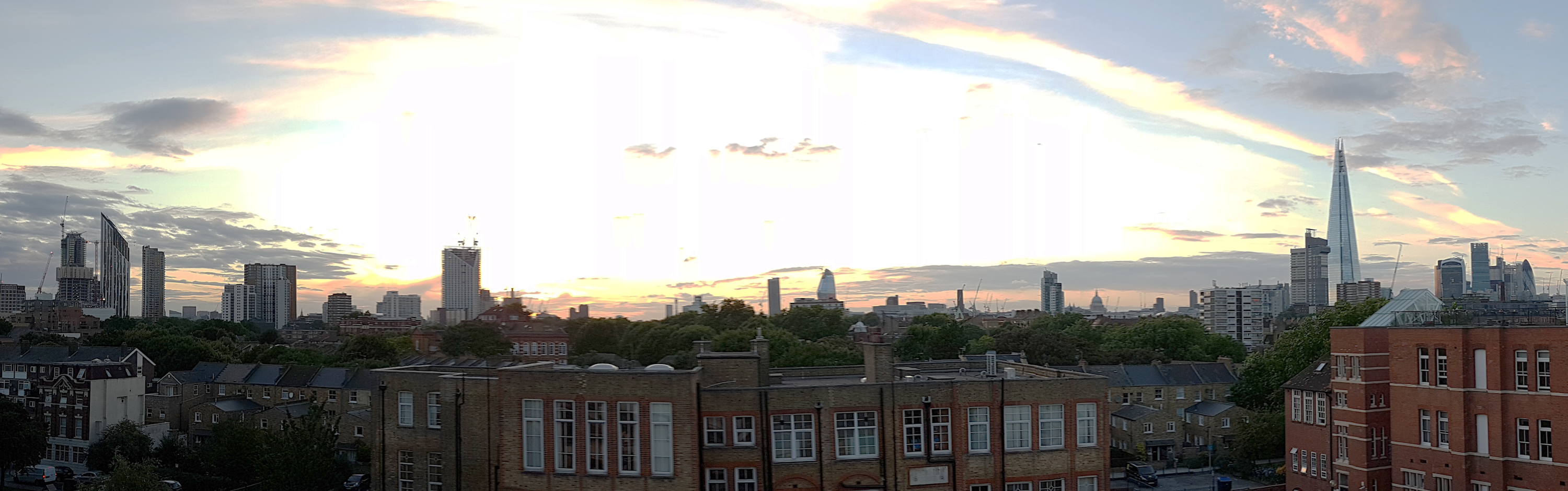

It’s no secret that London is a bit on the expensive side and you can better enjoy it with some pounds in your pocket. A small room in a shared apartment easily costs GBP 1000. Short-term accomodation can be tough to find and it’s very important to consider commuting time. London’s public transport system is extremely advanced, in fact, most Londoners don’t even own cars. However, distances between central London (where the BOE is situated) and locations with affordable accomodation can be substantial. After two weeks of househunting via spareroom.co.uk, I ended up in an area called Elephant & Castle south of the river - not the poshest area of London and there is crime, but how much worse than Johannesbug can it be? I had a nice spacious, fully furnished room, a British house mate, a view over the London skyline and a 15min bus ride to work which was markedly cheaper than the tube (GBP 1,50 vs GBP 5,00) - score!

|

Things to do

London has so many things to offer, I honestly didn’t know where to start. Historic museums, churches and sightseeing, music and shows in Soho and Westend, Wimbledon and Premier League football and Stonehenge close by.

Here are some tips if you spend some time there:

To get a nice overview on central London, take a cruise on the river Thames. There is a guide which accompanies the cruise with many interesting facts for every landmark building that is passed, so he is “speed-talking” for the entire cruise. Big Ben for example, is the name of the biggest bell inside the famous north tower of the Palace of Westminster, while the tower itself is officially called Elizabeth Tower. The Royal Festival Hall has been voted the ugliest building in the city, while the London Eye has overtaken the Eiffel tower as Europe’s landmark with most wedding proposals. Speaking of romance, the cruise is even nicer if you take it at sunset :)

For tickets to any locations book online and early! It saved us two hours waiting time for Madame Tussauds and I don’t know why people would go through that.

The London Dungeon was a tourist trap, so rather spend your time in one of the many historic museums (e.g. Churchill’s war museum)

Go up one of London’s high buildings. St Paul Cathedral and the London Eye both cost about GBP 20 to get in. The London eye ride is over in 30 minutes. The highest building in London - and in the EU - is the Shard. It was built by the Quatari and for visitors it costs about GBP 25 to go to the top. Hoewever, it’s completely free to go up 20 Fenchurch Street, the building that they call the walki talky, and you can spend the money saved in the glass dome on top of the building with a few restaurants and bars in the Sky Garden.

If you want to see a show in Westend, go see the Book of Mormons. It’s from the makers of South Park and funny as hell if you are insensitive to religious jokes.

|

The end

I left London rich with experience, knowledge and connections and would like to thank everybody who helped make this happen and supported me during this time.

|

References:

Greenwood, R & D Thesmar (2015), “Vulnerable Banks”, Journal of Financial Economics 102 (3), 471-490.

Eisenbach, T & F Duarte (2014), “Fire-Sale Spillovers and Systemic Risk”, 2014 Meeting Papers 541, Society for Economic Dynamics.

Cont, R & E Schaanning (2017), Fire Sales, Indirect Contagion and Systemic Stress Testing (Unpublished).

Mishkin, F. & Serletis, A. (2011). The economics of money, banking and financial markets. Toronto, Pearson Addison Wesley.

Shleifer, A & R Vishny (2011): “Fire Sales in Finance and Macroeconomics.” Journal of Economic Perspectives 25 (1): 29-48.

1: A specific question that I am personally intrigued by is - what do 10 years of QE, ultra-low interest rates and excessive debt creation do to the domestic and global economy?